Introduction

History teaches us that nonprofits flourish not just by enduring challenges, but by embracing innovation, diversifying revenue streams, and deepening community engagement. In today’s environment, nonprofit finance executives are uniquely positioned to lead this transformation. Their role extends beyond budgeting and reporting, they are strategic partners who can champion the adoption of new technologies, improve operational efficiency, communicate mission-driven outcomes, and strengthen governance and accountability.

Ensuring Resilience and Financial Stability

Nonprofits are not only grappling with reduced government funding but also facing escalating challenges. It is imperative that finance executives develop proactive and effective risk management strategies. Areas to consider:

- Economic uncertainty reduces donation outlooks across individuals, corporations, and foundations, which necessitates maintaining robust donor relationships through effective engagement strategies.

- Inflation-driven operational costs compel efficiency and creative resource utilization like shared services models and cost-saving collaborations.

- Increased funding competition highlights the importance of revenue diversification and effective storytelling to sustain operations and thrive.

- Volunteer and staff shortages underline the importance of retention programs, volunteer recognition, and employee development opportunities.

- Rising service demand amid limited resources demands careful program prioritization, strategic allocation of resources, and measurement of outcomes.

- Heightened donor expectations for transparency require clear impact reporting and consistent communication of results, which implies adequate technology.

- Urgent technology upgrades call for strategic investments in data management systems and tools to automate and improve program delivery and reporting.

- Regulatory compliance requires robust collaboration with legal, tax, financial reporting, and audit partners to guarantee accuracy and operational effectiveness.

- Growing threats like environmental change necessitate proactive risk assessments, contingency planning, and sustainable operational practices.

- Political and social divisions highlight the importance of active advocacy, public education, and adaptability to shifting regulatory landscapes.

Adopting a holistic, proactive approach to risk management allows organizations to systematically identify and tackle a wide array of challenges, ensuring they stay resilient, financially stable, and aligned with their mission.

Technology as a Strategic Driver for Sustainable Change

Today, nonprofits constantly have to do more with less. Technology is a powerful lever for revenue diversification and long-term sustainability. While 67% of nonprofits currently use donor management software, only 24% have implemented an AI strategy. They are missing valuable opportunities to streamline grant writing, enhance donor stewardship, optimize social media engagement, and leverage predictive modeling for fundraising.

Technology holds the key to higher revenue diversification. Today, 67% of nonprofits use donor management software but only 24% have implemented an AI strategy to help with grant writing, social media, donor stewardship, and predictive modeling.

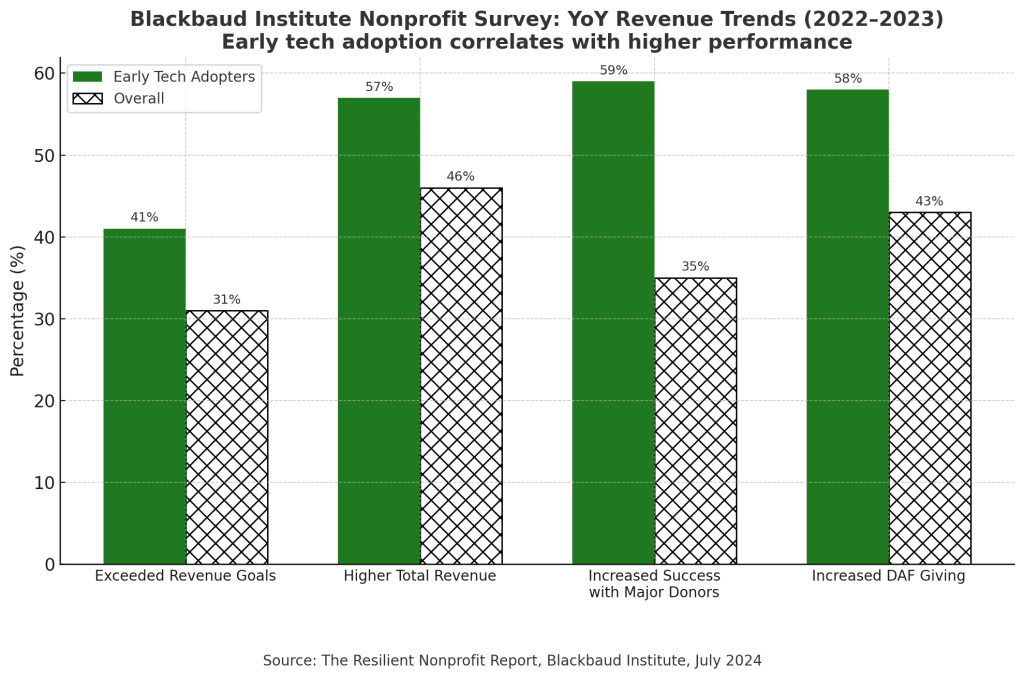

The data is clear: early adopters of technology tend to outperform their peers in fundraising performance. By championing innovation, finance leaders can help their organizations not only survive but thrive, unlocking new resources, improving impact, and advancing their mission in a rapidly evolving world.

Alt Text: Bar chart comparing nonprofit performance metrics between Early Tech Adopters and the overall sector from 2022–2023. Early adopters consistently outperform in exceeding revenue goals (41% vs. 31%), total revenue (57% vs. 46%), success with major donors (59% vs. 35%), and DAF giving (58% vs. 43%). Source: Blackbaud Institute, July 2024.

Community-Driven Transformation: Financial Executives Leading the Way

American nonprofits have repeatedly overcome disruption by adapting and leaning into their greatest strength: community. In times of crisis, strong local engagement has been central to nonprofit resilience. That legacy continues today. Despite ongoing uncertainty, charitable giving rose in 2024, with year-end contributions remaining consistent with trends from the past decade and prior election cycles. These patterns reflect a deep-rooted culture of generosity and enduring public trust in nonprofit missions, even during periods of economic and political volatility.

To navigate reduced government funding, the most powerful response is not retrenchment, but transformation through enhanced community involvement. By fostering a culture of resilience, preparedness, and adaptability, nonprofit finance executives are well positioned to lead the sector through meaningful change. Working in close collaboration with nonprofit leaders and community partners, their role is not only to manage resources but to raise awareness, amplify social impact, and ensure long-term sustainability.

By championing operational excellence, promoting transparency and accountability, and enabling mission-driven decision-making, finance leaders build donor trust, strengthen community confidence, and help nonprofits clearly articulate their value, especially at the local level, where real change begins.

Driving Social Impact: A Toolkit for Nonprofit Financial Executives

The effective nonprofit finance executive’s toolkit should include:

- Strategically Diversify Revenue Streams

- Develop a clear, data-driven roadmap for revenue diversification.

- Prioritize outreach to high-potential segments: major donors, corporate partnerships, foundations, individual donors, and earned-income initiatives.

- Use financial forecasting tools to model cash flow under different funding scenarios, ensuring sustainability and adaptability.

- Invest in Data-Driven Donor Analytics

- Perform donor segmentation analysis to tailor communications, boost engagement, and enhance retention.

- Regularly conduct donor lifetime value analysis, churn and retention rate analysis, and predictive modeling for donor behaviors.

- Use predictive analytics software (e.g., Fundraising KIT, Dataro) to proactively identify at-risk donors or those ready for increased engagement.

- Utilize web analytics tools (e.g., Google Analytics, Hotjar) to track online donor journeys, identify conversion bottlenecks, and optimize digital fundraising campaigns.

- Deepen Community-Based Partnerships

- Build collaborative networks with local businesses, schools, government agencies, peer nonprofits, and faith-based organizations to increase collective impact.

- Initiate joint fundraising events, shared-services arrangements, and collaborative partnerships to lower costs, achieve economies of scale, and create win-wins.

- Strengthen Financial Transparency and Impact Reporting:

- Invest in technology platforms that enhance impact measurement and reporting.

- Regularly report clear, outcome-based program metrics and financial results to stakeholders. Consistent performance metrics builds credibility and trust with funders, boards, and the communities you serve.

- Employ data visualization tools (e.g., Tableau, Power BI) to present compelling impact stories visually, improving credibility and transparency.

- Leverage Technology and Digital Transformation

- Build a technology roadmap to modernize systems for fundraising, reporting, and donor management. Take an end-to-end view of your data and processes.

- Adopt donor management systems (e.g., Salesforce Nonprofit Cloud, Blackbaud Raiser’s Edge, Bloomerang) to automate and enhance donor stewardship.

- Integrate AI-driven solutions for streamlined grant-writing, personalized donor communication, social media targeting, and donor engagement optimization.

- Conduct regular technology audits to identify opportunities for automation, enhanced cybersecurity, and improved operational efficiency.

- Implement Structured Change Management Practices

- Develop a structured approach to change, engaging board, leadership, and staff in planning and execution through clear communication, transparent planning, and consistent feedback loops. It builds adaptability and trust during transformation.

- Invest in training to build internal capabilities for managing change, emphasizing adaptability, resilience, and continuous improvement.

- Empower staff and volunteers

- Involve staff and volunteers in planning and transformation initiatives.

- Regularly assess and enhance organizational culture through engagement surveys and structured feedback mechanisms. Your people are your greatest asset.

- Implement meaningful volunteer recognition programs, targeted employee recognition and professional development plans to retain top talent.

- Enhance Governance and Compliance

- Establish rigorous internal controls, compliance checks, and clear policies to manage financial, operational, and legal risks proactively.

- Collaborate closely with auditors and legal advisors, ensuring accuracy, transparency, and adherence to evolving regulatory requirements.

- Strengthen advocacy and public engagement:

- Actively engage with local officials and community stakeholders through structured advocacy efforts positioning your nonprofit as a vital voice in the community.

- Develop educational materials and strategic communications to inform the community about your nonprofit and its role in addressing critical local issues.

- Maximize Storytelling for Impact

- Leverage emotional, data-backed storytelling to effectively illustrate your impact.

- Highlight compelling narratives in donor communications, annual reports, and digital campaigns to foster deeper connections and inspire increased giving.

- Utilize social media analytics (e.g., built-in insights from Facebook Analytics, Instagram Insights, LinkedIn Analytics) to identify content effectiveness, engagement patterns, audience demographics, and optimal posting times.

Nonprofit finance executives stand at a pivotal moment. More than stewards of resources, they are strategic leaders with the power to guide their organizations through change. In this time of uncertainty, their role is essential, not only in ensuring financial stability, but in shaping a more adaptive, innovative, and community-focused future.

By strengthening local partnerships and embracing technology as a catalyst for growth, finance leaders hold the keys to funding diversification, operational resilience, and long-term sustainability. Their leadership will be vital in helping nonprofits navigate today’s challenges and build stronger, more responsive organizations for the road ahead.

The path ahead will require clarity, courage, and collaboration. But as history has shown, when nonprofits lead with purpose and resilience, they don’t just withstand disruption, they thrive. Now is the time for finance executives to lead with vision and help write the next chapter of nonprofit transformation.

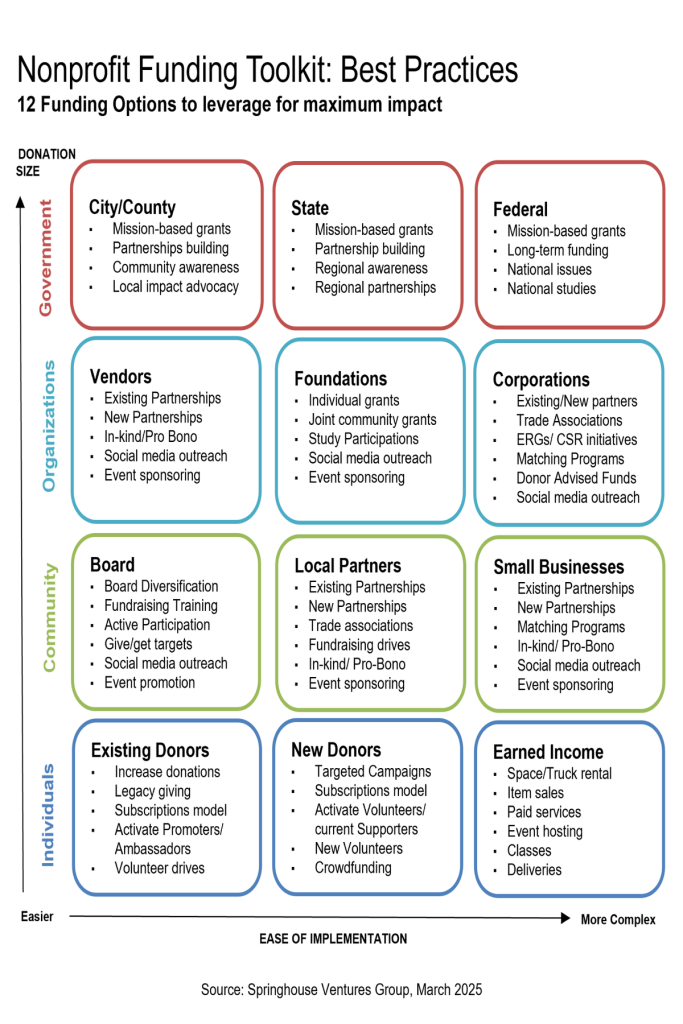

Alt Text: Infographic showing 12 categories of nonprofit funding opportunities across four sectors: Government, Organizations, Community, and Individuals. Each box lists specific strategies, such as grants, partnerships, event sponsoring, subscriptions, and earned income streams that nonprofits can adopt to diversify their funding.

Conclusion

The nonprofit sector is standing at a crossroads, but we are not standing still. Navigating decreased government funding, rising costs, and shifting expectations will require more than strong financial stewardship. It calls for courage, creativity, and a bold commitment to advancing the greater good.

The path forward won’t be easy, but it will be meaningful. If we lean into innovation, deepen community partnerships, and lead with transparency and compassion, we can build nonprofits that don’t just weather disruption, but grow stronger because of it.

This is the moment to step forward. Nonprofit financial executives have an extraordinary opportunity to shape this transformation. Our expertise is needed now more than ever. Lead the conversations. Invest in innovation. Build the partnerships that turn values into action. Together, we can turn complexity into clarity and ensure that every dollar, every decision, and every community partnership move us closer to a stronger, more equitable future for all.