Introduction

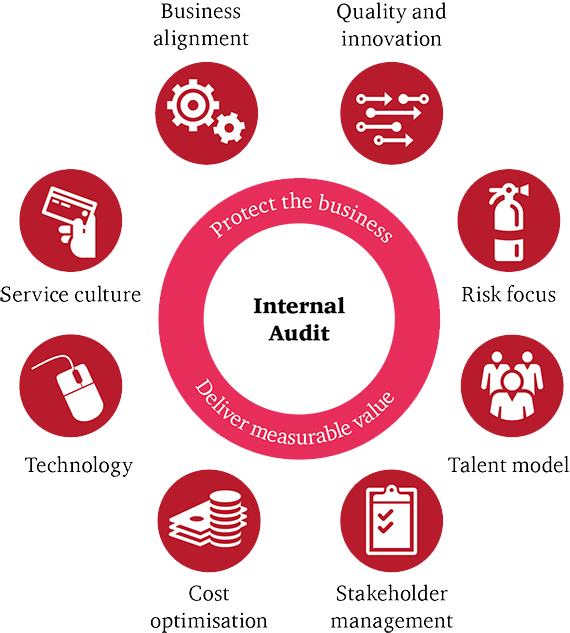

In today’s complex regulatory and financial landscape, the Internal Audit (IA) function is not a luxury but a necessity. Internal auditing’s primary objective is to provide independent and objective assurance that an organization’s risk management, governance, and internal control processes are operating effectively.

Most organizations think they have this covered with their external audit. This is not true at all. External audits ensure that the financial statements are free from material misstatements. This means that the external financial statement auditors focus primarily on financial reporting risks. Internal auditors use a broader risk assessment process, which places less weight on the financial materiality of an audit area and focuses more on the holistic impact a risk event could have on an organization.

What Happens When Internal Audit Is Absent? A Case Study Analysis

This section explores three real-world nonprofit scenarios in which a lack of—or delayed development of—an internal audit function led to significant financial and operational consequences.

After thirty years as an analyst at a Wall Street firm, I transitioned to a compliance role in the not-for-profit sector. In my current position, I consult with grantees to help them adhere to the terms of their allocation agreements. Non-compliance can often lead to poor audit results for our firm and difficult paybacks for the not-for-profit agency. Given the limited liquidity of most of these organizations, these paybacks can range from challenging to potentially devastating.

Establishing an internal audit function has been a significant challenge for most of our grantees without adequate implementation resources. This gap in internal auditing presents considerable risks and threatens the financial stability of nonprofits.

Case Study 1: Community Action of Minneapolis

Background: Community Action of Minneapolis was a nonprofit organization that operated in Minnesota to support low-income individuals and families. It offered critical services such as energy assistance, job training, and financial literacy programs. The organization received substantial funding from federal and state sources, making it a central resource for community support in Minneapolis. For years, it was viewed as a key partner in the fight against poverty—until a state audit revealed deep-rooted financial misconduct.

Problem: The lack of internal auditing and financial oversight enabled the misuse of public funds by executive leadership. According to the audit, the CEO, misappropriated over $226,000 in unallowable employee and executive travel expense. Additionally, the organization overcharged state and federal grants by more than $600,000 for administrative costs. These activities went undetected for years due to weak internal controls and a disengaged board of directors.

Impact:

- Immediate closure of the nonprofit in 2014

- Termination of 41 employees

- Disruption of services for thousands of low-income residents

- Loss of public trust in nonprofit oversight

- Legal scrutiny and reputational damage to leadership and affiliated public officials

Analysis: This case illustrates the critical importance of internal auditing and board accountability in nonprofit management. The absence of proper checks and balances allowed fraudulent behavior to go unchecked. Staff who raised early concerns faced retaliation, and the board failed to question financial decisions or require independent audits. Strong governance practices—including regular audits, transparent reporting, and protection for whistleblowers—could have prevented this organization’s downfall.

Reference: Nonprofit Quarterly. (2014). Political Ties and Lack of Oversight Enabled This Nonprofit’s Mismanagement.

Case Study 2: Climate United – Clean Energy Nonprofit

Background: Climate United, a clean energy advocacy and funding nonprofit, was slated to distribute over $20 billion in green bank funding under a federal initiative.

Problem: The U.S. Department of Energy froze Climate United’s funding amid allegations of financial mismanagement and conflicts of interest.

Impact: This freeze disrupted project rollouts, caused job insecurity, and cast doubts on the nonprofit’s capacity to manage large-scale funding responsibly.

Organizational Response: Climate United initiated the hiring process for a Director of Internal Audit and Risk in response, signaling a strategic shift toward structured internal controls and risk management.

Analysis: This case exemplifies reactive governance, where internal audit structures are introduced only after significant damage is done. Proactive internal auditing may have mitigated or avoided the crisis entirely.

Case Study 3: Polk County Housing Services (PCHS) – Iowa

Background: PCHS was contracted to manage housing services in Polk County, Iowa.

Problem: The agency became increasingly unresponsive to financial reporting and documentation requests, eroding trust with the county.

Impact: The county terminated the contract in 2022. This led to legal disputes and a settlement payout of approximately $840,000 to Polk County.

Internal Controls Status: There is no public evidence that PCHS maintained an internal audit function. The lack of responsiveness and financial clarity indicates weak internal controls.

Analysis: This example highlights how the absence of internal audit mechanisms can contribute directly to contract termination, legal battles, and reputational damage.

The Significance of an Internal Audit Function

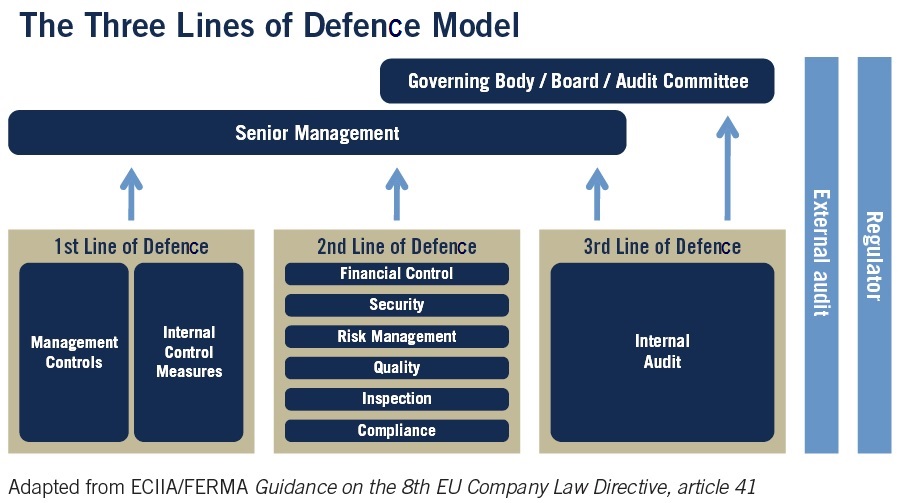

Internal Auditors are invaluable to an organization. They assess processes to identify and manage risks, develop and implement appropriate internal controls, assure management and the Board of Directors of the company’s adherence to policies and regulatory requirements, and the effectiveness of its processes and operations.

- Internal auditors play a crucial role in assessing processes to identify and manage risks and develop and implement appropriate internal controls.

- Internal auditors assure management and the Board of Directors of the company’s adherence to policies and regulatory requirements and the effectiveness of its processes and operations.

- Internal auditors provide consulting services that examine issues and pinpoint potential solutions.

- Internal auditors primarily conduct operational audits to assess effectiveness, efficiency, and economy of resource utilization.

Benefits of an Internal Audit

Despite the added value, whether through hiring an audit firm for a comprehensive audit or creating a department within the organization, most not-for-profits lack the resources for these functions. Additionally, many philanthropists do not find these issues compelling enough to invest in. Philanthropists primarily focus on direct results for the causes they support, and numerous firms evaluating charitable giving stress the importance of minimal management expenses.

Conclusion

Effective governance of the Board of Directors constitutes a comprehensive management approach wherein senior executives employ management information and hierarchical control structures to direct and supervise the entire organization. Governance activities ensure that critical management information reaching the executive team is complete, accurate, and timely enough to support sound decision-making while providing the control mechanisms essential for systematically and effectively implementing management’s strategies, directions, and instructions. The Internal Audit function serves as a tool to facilitate good governance. Can you afford to forgo an Internal Audit Function?