Financial Operations are entering a new transformative era driven by artificial intelligence and automation. At the center of this transformative era is agentic AI. Eventually this will lead to autonomous, “self-driving” AI systems that can perceive, reason and act with very limited and in some cases no human interaction. Today we are at the embryonic stage of maturity and are just linking this technology capability to the right business processes where it will add the most value. Unlike today’s generative AI (which requires human prompts) or very scripted Robotic Process Automation (RPA), agentic AI will operate continuously and adaptively, effectively functioning as a digital worker. This article takes a look at how agentic AI impacts finance operations, provides insights into information service group trends, and explores the next evolution of Business Process Outsourcing (BPO).

The Power of Agentic AI

In finance ops, agentic AI can automatically pull data from systems, analyze it, and carry out tasks (like reconciling accounts, invoice validation, or adjusting budgets) with minimal oversight. Additionally, agentic AI has the power to transform the entire BPO services landscape beyond finance operations. We are already seeing agentic AI being applied to procurement, supply chain and even some of the most coveted industry specific business process. CFOs should note that agentic AI is not science fiction – it is already starting to take over the more simple and transactional tasks traditionally outsourced, as demonstrated with recent demos from service providers such as Genpact and Accenture.

Service providers are investing heavily on cutting edge AI capabilities with the intention to transform service delivery models to agentic digital employee models versus the traditional offshore-based service delivery models of the BPO industry. Major financial institutions such as Citibank and tech firms like Salesforce are already experimenting with AI agents that autonomously handle customer service interactions, financial processes, including more complex processes like budgeting, and even compliance and regulatory industry processes like KYC (Know Your Customer).

Information Service Group (ISG) Trends

The rise of agentic AI is one of three ISG research-backed trends transforming finance departments:

- AI-Driven Automation and Intelligent Agents: Finance tasks from invoice processing to forecasting are increasingly automated. As already discussed, Generative AI and machine learning models help analyze data, but the frontier is agentic AI “copilots” that autonomously execute processes. These agents can handle unstructured data and exceptions – for example, learning to adapt workflows rather than rigidly following scripts.

- Continuous Close and Predictive Accounting: The traditional month- or quarter-end close is shifting to a continuous, real-time process. Transactions are recorded and reconciled as they occur, reducing bottlenecks and enabling a “soft close” at any time. With AI and predictive accounting, CFOs gain real-time visibility into cash flow and performance—turning the close into an ongoing, streamlined function rather than a rushed period-end task.

- Digital Twins for Finance: Digital twins – virtual models of financial systems – are gaining traction. A digital financial twin integrates data from ERP and other systems to simulate financial outcomes. It precisely attributes costs and revenues to products, customers and processes, and can run “what-if” scenarios. Service Provider TCS highlights that CFOs can use finance digital twins to predict errors before they occur and monitor key indicators interactively. In practice, this means a CFO could tweak inputs (like prices or volumes) and see the projected impact on profit and cash in real time, using tools like start up Perceptura.

Agentic AI in Action: Realistic Scenarios

The broad promise of AI is a shift from manual work to supervisory roles with forward-thinking finance leaders beginning to initiate AI pilots. Here are some scenarios:

A large manufacturing company used an AI Agent to manage its month-end close process. The AI agent autonomously gathered trial balances from multiple ERPs, ran matching rules, and even proposed adjusting entries allowing the finance team to only review the summarized recommendations, cutting the close cycle by roughly 50%.

Another global retail CFO experimented with an AI negotiation assistant for procure-to-pay. The agent analyzed historical payment data, current cash forecasts, and supplier credit terms, then engaged with vendors’ digital portals to secure extended payment schedules consistent with policy.

In treasury, a financial services firm tested an agent that continuously monitors FX markets and cash positions, autonomously rebalancing currency swaps to hedge risk in real time. In each case, the AI handled the mechanics, while the finance team focused on exceptions, strategy and oversight.

These examples illustrate the pattern that CFOs are becoming more comfortable with outsourcing cognitive labor to AI. ISG Research notes, “AI agents can do more than follow rules and checklists – they can understand and apply context, like tax laws and your company’s history”. CFOs envision finance staff partnering with AI: humans set goals and guardrails, while agents execute routine analysis and planning.

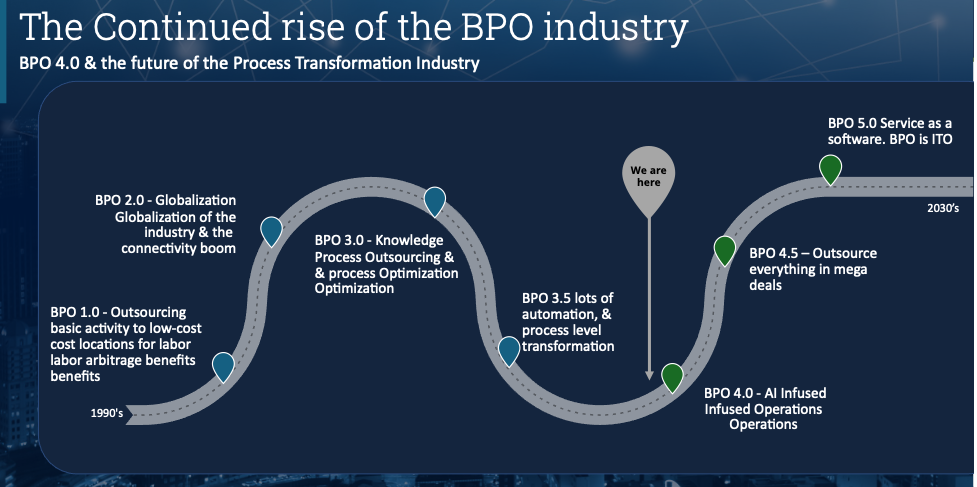

Impact of BPO 4.0 on Financial Services

With internal company finance departments undergoing various levels of transformation, the agentic AI revolution also carries profound implications for finance BPOs and consultancies. Traditional outsourcing has thrived on scaled human labor for financial administrative tasks. However, AI agents can perform these tasks 24/7, the traditional human labor cost arbitrage model significantly erodes. Already, routine back-office functions like claims processing, reconciliations, and simple customer service are being automated end-to-end by AI, providing cost reductions to end clients of up to 60% compared to human lead models of the past. The new BPO delivery model is shifting away from a human first model to an AI first model paving the way for the BPO industry to enter the 4th Generation of BPO.

Does this mean that we will see the end of the industry? No, far from it, but that doesn’t mean there won’t be winners and losers in the service provider community.

There are some BPO providers that are adapting rather than retreating. Almost all are embedding AI into their offerings and adapting their pricing structures. Instead of simply delivering low-cost labor, they aim to be AI first. In practical terms, this means BPO deals will likely bundle AI and human services, focused on outcomes. CFOs can expect to see very different pricing as a result of this shift, and we should expect a small amount of turbulence over the next few years, as we re-settle on how to price this AI first workforce, vs today’s human centric. BPO firms that focus solely on human-driven outsourcing may find themselves displaced. Conversely, firms that transform into AI-savvy advisors – managing data governance, model training and ethical oversight – will have a significant role in the future finance transformation ecosystem, so there is a lot of opportunity as well as risk in the industry.

Preparing for the New Finance Frontier

For CFOs and finance executives, the agenda is clear. The coming years will see finance operations become smarter, faster and more autonomous, and service providers will be closely aligned to this transformation. To succeed, finance leaders must invest in data quality, and AI literacy. This includes establishing governance guardrails for AI usage– ensuring data accuracy, bias controls, security and explainability – as the World Economic Forum and others stress. Executive teams will need to clarify accountability when AI agents act. Applying critical thinking to understand -Who signs off on decisions made by an agent? How are unexpected outcomes escalated?

At the same time, CFOs should champion change management. Staff will be working alongside digital agents, so roles will shift. Many routine accounting and finance jobs may evolve into roles that oversee AI, analyze exceptions flagged by AI, and provide strategic insight. Finance departments should proactively upskill in data analytics, AI oversight, and cross-functional collaboration, in order to continue to evolve their role into the future

Ultimately, agentic AI and related innovations are tools to amplify the finance function. When guided effectively, they promise to free finance from repetitive tasks, deliver near-real-time insight, and enable proactive decision-making.

Conclusion

The future of finance operations lies in intelligent, integrated systems, not siloed human processes. Agentic AI sits at the heart of that future – but success will require thoughtful adoption. CFOs who experiment now, build partnerships with tech-forward providers, and invest in strong governance, will position their organizations for the next wave of finance innovation.

Key Takeaways for CFOs:

- Agentic AI is here. Finance teams must evolve from task execution to supervising autonomous digital coworkers that drive speed, accuracy, and insight.

- Outsourcing is changing. Traditional BPO models are being disrupted by AI-first service providers – expect new pricing, expectations, and partnerships.

- Real-time finance is the future. Embrace continuous close, predictive analytics, and digital twins to move from reactive to proactive decision-making.

- Don’t Do it Alone. Your particular challenges maybe unique to you, but unlikely to be unique overall. Don’t be afraid to ask for external support.