Introduction

Traditionally, the CFO’s role has been centered around core financial responsibilities such as reporting, budgeting, forecasting, cash flow management, and ensuring regulatory compliance. While these responsibilities remain crucial, today’s CFOs are stepping into a more strategic, forward-thinking role that drives business development, fosters growth, and fuels innovation. This article explores how combining financial expertise with a business development acumen can drive growth, optimize strategic investments, and align a company’s financial strategy with its long-term business goals.

What do Business Development Skills Bring to the Table?

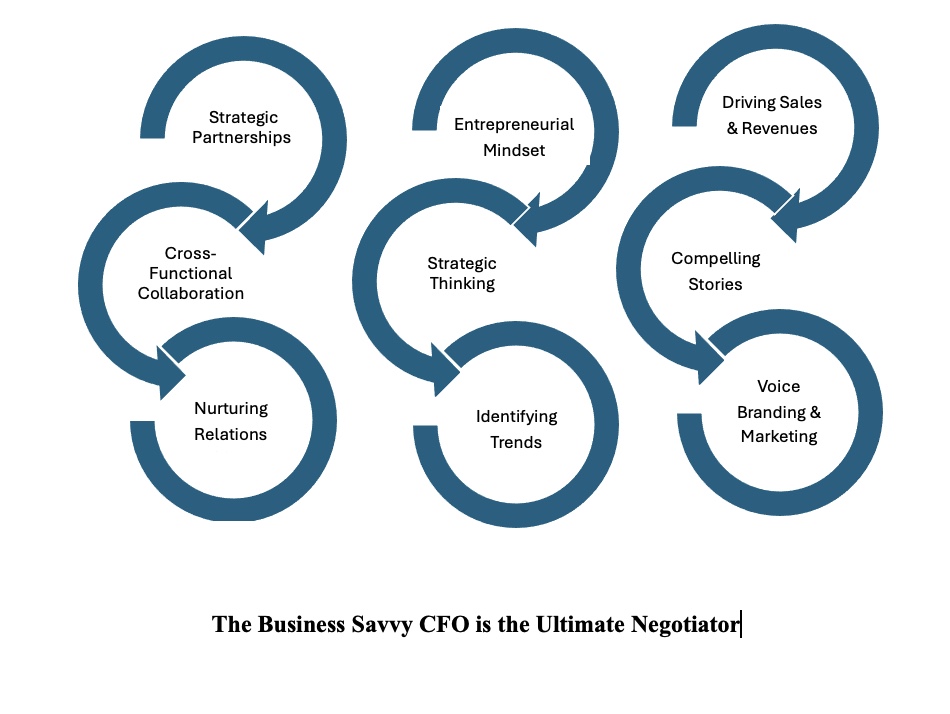

Business development skills bring a deeper understanding of market dynamics, entrepreneurship, customer/stakeholder demands, and the competitive landscape. Business Development savvy CFOs can incorporate these elements, and bridge finance and strategy, bringing their diverse skill set to the negotiating table, in any industry vertical. CFOs can also better assess risks associated with business expansion, new markets, products and partnerships. Here are some of the ways Business Development savvy CFOs apply their skill set:

A business development savvy CFO is the ultimate negotiator. They see through a muti-faceted and diverse lens. They know how to build strategic partnerships and alliances, and nurture relationships to establish trust and understanding with partners, stakeholders, clients and third parties. They also recognize that cross-functional collaboration is key to success. Throughout their career they seek to work closely with product, sales, marketing, technology, risk and investment teams, to develop strong business insights to bridge finance and strategy to support organizational success.

Business savvy CFOs also have an entrepreneurial mindset, going beyond financial analysis, integrating market factors, competitive landscape, industry regulation and client needs. They know how to apply their strategic thinking to identify and capitalize on new business opportunities such as market expansion, new revenue models, or strategic partnerships. They are perceptive at identifying trends and grasping market insights and customer/client demands, to remain relevant and to maintain a competitive edge.

They have effective communication skills, both verbal and written. They help drive sales and revenue growth by providing structure. They create multifaceted, data-informed narratives that focus on key metrics, to help sales teams manage pipelines, stay on track, and ensure alignment with growth pillars. They utilize actionable metrics for accountability and to ultimately measure success in sales, asset and revenue growth. They create compelling stories and business cases to successfully support new products and strategic initiatives and provide direction and focus on ROI. They also represent the brand voice and help to ensure that the value proposition to customers/clients is effectively weaved into marketing and branding strategies.

A business development savvy CFO is always negotiating whether it be about budgets, capital spend, resource allocation, new investments, vendor contracts, or working synergistically towards achieving common strategic objectives. It is a careful balancing act; always looking to achieve a win-win outcome.

The Impact of a Business Development Savvy CFO (The ABCs)

Let’s take a deeper look at how finance and business development expertise are weaved together for powerful impact.

A. Leadership

- Strategic Growth Leadership: CFOs bridge finance, strategy and risk. They have an entrepreneurial mindset that can help identify growth opportunities, optimize resources, innovate, drive operational efficiency and evaluate funding. They also apply data-informed decision-making and create actionable metrics for accountability, to guide an organization to achieve high-impact growth initiatives.

- Foster Cross-Functional Collaboration: CFOs have the ability to work closely with business partners (sales, marketing, product, investment and operations teams etc.) aligning financial and strategic goals. They recognize that this is essential for optimizing revenue and growth potential, gathering a complete picture of costs, effectively manage resources, mitigate risk, and ensure that financial strategies are directly linked to the company’s overall business objectives.

B. Critical Thinking and Emotional Intelligence

- Innovative Problem-Solving: CFOs play a vital role by proactively identifying potential challenges and collaborating with business development teams to find creative solutions. By leveraging their financial acumen, they find cost-effective ways to overcome obstacles and facilitate the execution of strategic initiatives. Whether it’s identifying funding solutions, optimizing resource allocation, or revisiting pricing strategies, Business savvy CFOs can drive innovation to help an organization move past barriers to achieve growth targets.

- Driving Organizational Agility: CFOs contribute to organizational agility by applying critical thinking to financial strategies and business development decisions. They help an organization quickly pivot to support evolving business needs, assess new opportunities, evaluate risks, and fine tune budgets and financial plans to stay on track. They also empower teams and promote continuous learning with development opportunities. This in turn helps them stay adaptable and equipped to respond to new challenges. After all, you are only as good as the team that supports you.

- Create Compelling Business Cases: CFOs are well-positioned to “tell the story” by creating data-informed narratives that justify new investments, strategic initiatives, or business ventures. They can simplify data by extracting and interpreting the relevant data points to create compelling, informed business cases that align financial data to strategic objectives and growth strategies. They apply their critical thinking and emotional intelligence to convey key messages to diverse audiences, making it easier for leadership to make informed decisions.

- Risk Mitigation: CFOs evaluate the risks associated with growth strategies. Whether it’s expanding into new markets, launching new products, or forming strategic partnerships, every business initiative carries some level of risk. As financial stewards, they ensure that business development initiatives are pursued in a measured and financially sustainable manner. This is done by embedding risk metrics into financial analysis, ensuring that best-and worst-case scenarios are accurately presented and capture market dynamics, to minimize the potential for negative financial outcomes.

C. Financial Expertise

- Forecasting and Financial Modeling: CFOs play an integral role in bridging the gap between finance and business development. Through accurate forecasting and planning scenarios for sales, revenue, and market trends, they can project revenue potential and identify opportunities for enterprise growth. By regularly updating forecasts and incorporating business development insights, CFOs ensure the financial strategy is responsive to changing conditions, giving the company a competitive edge.

- Performance Metrics and KPIs: CFOs work with business development teams to define key performance indicators (KPIs) that align with both financial and strategic goals. They assist by analyzing profitability and client/product segmentation, market share and return on investments. This data can inform marketing, product and sales strategies, helping business development teams tailor their approach to attract and retain the right customers/client and develop the right products.

- Enhanced M&A Expertise: CFOs bring a sharp lens to the financial health of target companies, performing valuation and gap analysis leading to more successful integrations. Through careful due diligence, they help ensure that M&A deals are aligned with the company’s strategic long-term objectives.

- Optimize Resource Allocations: CFOs hold the purse strings. They are best positioned to assess capital spend and resources needed to determine the ROI for the successful execution of strategic initiatives. Finance and business development teams can work closely together to ensure that capital is allocated to the most auspicious and attainable growth opportunities.

How CFO’s Develop and Strengthen Business Development Skills

CFOs can strengthen their entrepreneurial mindset and business development skills in the following ways:

- Invest in Learning: The optimal and most tangible learning comes from peer interaction. Learn from those who have mastered these skills. You may also want to consider enrolling in courses in areas like strategic management or attend conferences to develop a deeper understanding of how business development intersects with financial strategy.

- Cross-Functional Experience: Gain hands-on experience in business development by actively seeking projects that require collaboration with other departments such as sales, marketing, and product development. Cross-functional exposure will help you to develop a broader perspective on business growth and learn how to align financial strategies with broader business objectives.

- Cultivate an Entrepreneurial Mindset: Adopt an entrepreneurial mindset by proactively seeking growth opportunities within an organization. This involves thinking beyond traditional financial controls and identifying areas for expansion, partnerships, or market penetration. By developing this proactive and growth-focused mentality, you can become a key player in driving organizational long-term success.

- Collaborate with External Stakeholders: Build relationships with external partners, including investors, clients, industry leaders and third parties, to help better understand the broader business landscape and to refine business development strategies. Collaboration, networking and forming strategic alliances can potentially uncover new revenue streams and business opportunities.

- Leverage Data and Analytics: Utilize your financial expertise by applying a data-driven approach to identify business trends, behaviors and areas of growth and risks. Don’t get overwhelmed by the data. Apply your perceptive skill set to extract key data points. Adopt a long-term perspective and enhance forecasting to anticipate trends and disrupters to navigate your organization through transitions, market shifts, and to remain competitive and relevant.

- Foster a Culture of Innovation Within Finance: Build and leverage technology and visualization tools to support business development initiatives, strategic goals, identify new revenue streams and explore cost savings, to fund strategic growth initiatives.

Conclusion

CFOs with combined financial expertise and business development skills have a powerful impact on an organization. They are effective negotiators, problem solvers, risk mitigators, innovators, gate keepers and the voice of reason. They have the ability to execute growth strategies effectively, adapt to changing markets, and ultimately achieve long-term success. They ensure that the financial resources of the company are used in ways that link finance with strategy for sustainable growth. They have a highly desirable and transferable skill set that can be applied to any industry. These leaders understand that in times of volatility, you stick to your strategic objectives and continue to invest in growth opportunities to maintain a competitive edge.