SUMMARY

“It’s all in the numbers” as the experts always say. Global M&A was predicted to be US$1 trillion by first half of 2024. The snapshot following discusses trends in capital markets activity; debt, equity, and mergers and acquisitions trends in particular, while highlighting select companies and deals that have occurred or financings that may be on the horizon. Overall, the sentiment is primarily positive and there is appetite and opportunity as we look closely to explore and analyze the capital markets through the introduction, outlooks, financing types, and trends.

INTRODUCTION

In the world of capital markets and debt and equity financings, utilized by companies of all sizes and trajectories, it is most advisable that as a banker or advisor you should ponder all aspects of the company and the markets in current times. Strategically structuring or advising is an ideal way to go considering that cost and optimal capital structures go a long way for any sustainable business model of a company that may want go from early stage to being a large corporate. However, we cannot eliminate options such as successful exits depending on how beneficial they may be. With this in mind, I always wondered how William Sharpe had the foresight in the 1960s of introducing that taking on more risk as being good rather than not, as they say nothing ventured nothing gained, and implying that the asset’s value is key. Yet recalling that Adam Smith’s free markets and self-interest notions in economic theory; I think they are along the same lines if applied to the corporate sector and capital raising nuances. So, in looking at 2024, in terms of market conditions, the debt capital markets, the equity capital markets, mergers and acquisitions trends (touching on private equity as well), and select notable companies with marketable business models, utilizing the capital markets follows.

Equity Capital Markets (ECM) IN 2024

The equity capital markets saw an increasing amount of issuance in 1Q with IPOs, follow-on, block trade and convertible volume up over 100% year-over-year and a more constructive investor sentiment towards new issuance activity. March 2024 ended as the most active month since November 2021, accounting for 43% of the total Q1 volume.

“Optimism towards potential rate cuts later in 2024 combined with the continued strength in the economy propelled equities higher with all major equity indices hitting all-time highs. These favorable market conditions led to a resurgence in equity issuance in Q1,” according to ICR Capital.

The follow-on market with $43 billion in gross proceeds, and financial sponsors took advantage of the favorable market conditions, raising $27 billion in secondary proceeds. The increase in capital markets activity was bolstered by a continuation of strong pricing outcomes. Most notably, IPO activity increased to 15 IPOs raising over $7 billion in proceeds, more than tripling year-over-year IPO issuance. Notable offerings in Q1 included IPOs for Brightspring Health, Amer Sports, BBB Foods, Astera Labs and Reddit. With these in mind, given market sentiments and the recent AI boom, high-profile tech IPOs by Reddit and Astera Labs were well received by investors, demonstrating strong aftermarket trading. This has sparked the attention of other pre-IPO tech companies, and I am speculating more activity to come.

From my reading, most expect issuers in technology, healthcare, and consumer sectors to be among the leaders in IPO activity in 2024 and 2025. Another driving force behind the strong ECM activity in Q1 was the convertibles market (used by high growth early-stage companies mostly) which saw an explosion of issuance as high interest rates, rising stock prices, and a wall of debt maturities in 2024 and 2025 led to the highest quarterly convertible issuance since Q1 2021. There has been over $20 billion of issuance across 31 deals, increasing 51% year-over-year. Q1 has been extremely active, and March 2024 saw the busiest week of convertible bond issuance since February 2021.

Debt Capital Markets (DCM) IN 2024

The DCM market has been resilient needless to say despite uncertainty. There has been market volatility with combined geopolitical tensions and central banks increasing interest rates offset increasing inflation, which is what led to turmoil in DCM back in 2023. The major central banks are gearing up for a potential shift in their interest rate hikes and economic policies when the Federal Reserve cut its key interest rate in November 2024 by a quarter-point in response to the steady decline in the once-high inflation.

Refinancing volumes in LevFin increased to 74% of total volumes in the first half of 2023, significantly reducing the number of maturities in 2024 and 2025 – what this means is that debt financings in this market will be less susceptible to enhanced credit risk and companies with favorable net income can be ahead. Also noted is that $101 billion worth of US leveraged financings mature in 2025 and $185 billion in 2026. It appears that issuers expect a recovery in M&A to increase leveraged financings. Higher interest rates made borrowing expensive which impacted small businesses and are risky for borrowing companies, but they made a minimal impact on large corporates.

Taking into view the interest rate environment, the benefit of higher net interest income would end if the Fed’s interest rates are not reduced, as many debt instruments fall, due in the coming two years, and corporates would need to refinance them at higher interest rates, according to many in the markets. The US, Europe and UK economies are set to see slower growth; the US and Europe, FRB, and the ECB, have also cut interest rates as of September 2024.

International Debt Capital Markets Volume

This chart shows the number of deals and the volume in USD millions for the global debt capital markets from the 4th quarter of 2019 up to and including the 3rd quarter of 2024, illustrating the demand for debt financing.

Source: Dealogic

2024 AN ECM FINANCING

Given the markets, there have been a number of financings in both capital markets, and I believe the fundamentals around a few of them are extremely positive to examine for varying reasons. One company yet to go IPO is San Francisco-based Stripe. This digital payments provider, is seeking a high valuation of $65 to $70 billion. With Sequoia Capital, among many other names backing it, pushing its potential valuation closer to $70 billion, coupled with free cash flow as of 2Q/2024, it should attract even more investors. It raised $9.8 billion funding from 117 investors or so in 25 rounds, $16 billion in revenues. I also learned that earlier this year, Stripe noted in its Annual Letter that the 15-year-old company cleared $1 trillion in total payment volume in 2023, up 25% from 2022. Its major customers are OpenAi, Anthropic, Amazon, Target, Apple to name a few. Looking for growth, Stripe, founded in 2010, is well positioned for the capital markets and an IPO;. The questions of whether it is overvalued will arise, but in the Fintech world and amongst its peers, I believe it stands apart as an immensely profitable company based on its fundamentals, and sustainable business model thus far. There is something to be said for executing an idea and growing it to a Unicorn for sure, but in my mind the key to this is creating an effective “marketplace” and so cheers to the brothers (CEO and Co-CEO of Stripe, Patrick Collison and John Collison).

2024 A DCM FINANCING

In DCM there are a variety of financing types, investment grade (IG), leveraged finance (LevFin), sustainable debt, and other variations as well. It is essential for middle market companies and large corporates, in particular, to utilize the loan market for growth in view of their business model goals, interest rate environment and debt covenants, to reposition for future financings.

At year-end 2023, I came across the financing by PE firm Leonard Green & Partners to acquire Netherlands-based artificial turf producer TenCate Grass (TenCate) for approximately $2 billion. The transaction was financed through a first-lien US$ term loan B (TLB) of $685 million and a EUR term loan B (TLB) of €350 million ($380 million) and an equity contribution of $970 million. The intricacies of the structuring and negotiated terms are disclosed to an extent by S&P and as follows.

The funds will be used to purchase equity, repay the existing debt, pay transaction-related fees, and provide $15 million in cash on balance sheet after the closing of the transaction. Additionally, the structure will include a revolving credit facility (RCF) of $150 million and a delayed draw TLB of $150 million. This transaction closed 1Q/2024. It was given a B issuer credit rating to Touchdown Acquirer, the future holding company of TenCate, and B issue rating to the new secured TLB issued by Touchdown;. this is a financing with all the “bells and whistles” on it. According to S&P Global, “the stable outlook indicates TenCate’s operating performance will remain resilient, credited to a successful product pipeline launch and its expansion in the U.S., with S&P Global Ratings-adjusted debt to EBITDA of about 5.0x and a funds from operations (FFO) cash interest ratio of 2.2x-2.5x over the next 12 months.” The nice thing about a TLB financing is the institutional investor base, which is generally secured, and it offers a floating interest rate. This is all attractive for companies. What the accessibility of getting a TLB at favorable pricing can vary, but the floating interest generally being lower than a fixed is attractive for companies in itself (and SOFR is at 4.82% as of November 8, 2024).

Private company TenCate is a leading, vertically integrated manufacturer, distributor and installer of artificial turf and other surfaces for Sports, including those for football, soccer, baseball, softball, field hockey and a variety of smaller sports as well as for the rapidly growing outdoor living segment. Headquartered in the Netherlands with its main manufacturing facilities in the Netherlands, the United States, and the United Arab Emirates, the Company serves customers in more than 40 countries. Please also see www.tencategrass.com.

M&A TRENDS 2024 – A SCIENTIFIC PERSPECTIVE

In 2008, I was at BNP Paribas, and at that time one of our key client’s were Spirit AeroSystems, an entrant in the Aerospace & Defense market. As of this July 2024, Boeing acquired Spirit AeroSystems in an $8.3 billion transaction. Details are that the Boeing Company (NYSE:BA) is to acquire Spirit for $37.25 per share in Boeing common stock. At $37.25 per share, this represents an Equity Value of approximately $4.7 billion and an Enterprise Value of approximately $8.3 billion (including Spirit’s last reported net debt). The price of $37.25 per share represents a 30% premium to Spirit’s closing stock price of $28.60 as of February 29, 2024. I understand the key rationale was that there will be strategic integration given both companies’ manufacturing and engineering capabilities, including safety and quality systems, and stabilize supply chain. Spirit has come a long way from 2005 under Mr. Shanahan’s leadership, the CEO of Spirit; it is also noted that the affiliation with Airbus (EUR: AIR PA, the European multinational A&D company) will benefit Spirit. This M&A deal is one to watch as it will attract further investments and financings in this industry and in others as well possibly, it is expected to close in mid-2025. Otherwise, some key takeaways or trends now in the M&A market are as follows:

KEY TAKEAWAYS (AS OF JULY 2024)

- Dealmakers remain cautious amid economic uncertainty, concerns about inflation and monetary policy, and regulatory and geopolitical headwinds. However, according to Boston Consulting Group, the global value of M&A activity for the first half of 2024 was higher than that for the corresponding period last year but below the 10-year average. I agree that factors promoting a positive outlook for M&A include the ongoing push for digitization, the energy transition, and the need to future-proof business models – is this possible? Yes, this is possible!

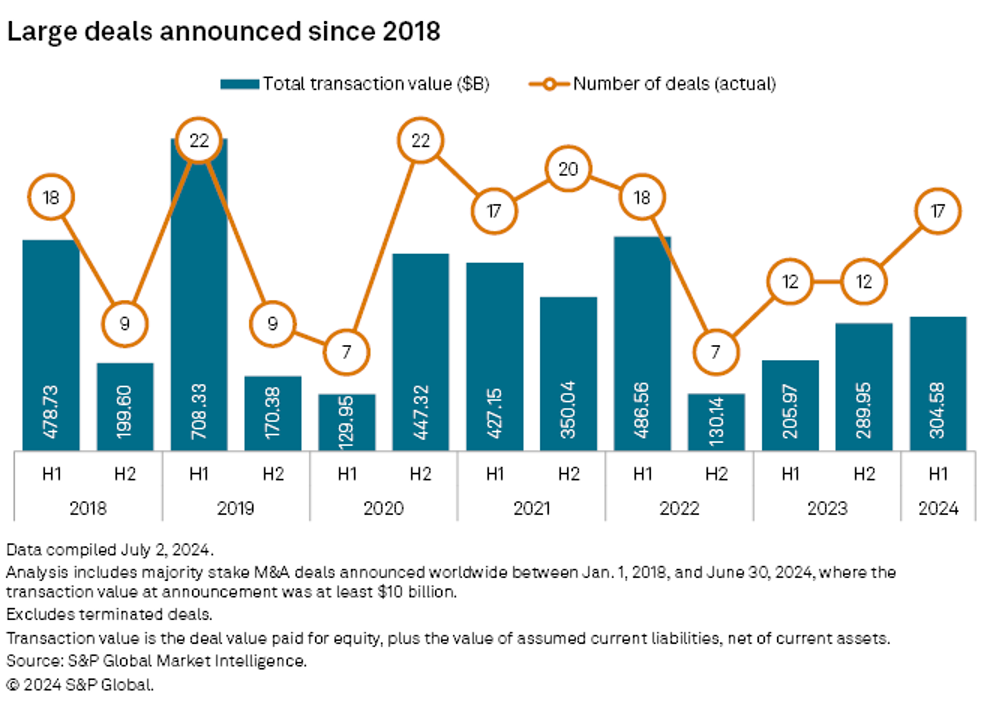

- The global value of M&A activity in the first half of 2024 was $1.0 trillion. (For some perspective, although this figure is 4% higher than that of the same period last year, it is below the 10-year average of $1.5 trillion.)

- Deals involving targets in the Americas had a total value of $647 billion, an increase of approximately 14% versus the first half of 2023. The vast majority (worth $631 billion) involved targets in North America, accounting for 61% of overall global M&A activity. US companies acquired most of these targets.

- The value of European M&A totaled $255 billion, a 23% increase compared with the first six months of last year. Deal value in the UK increased by 185%, resulting in the country’s highest share of European dealmaking since 2015. Deal value also increased strongly in Sweden (138%), Spain (19%), and the Czech Republic (196%).

- Deal value in Asia-Pacific declined by 40% to an 11-year low of $117 billion. The regional total was marked by declines in Japan (–67%), China (–36%), South Korea (–16%), and Australia (–39%). Brighter spots included India (55%), Singapore (41%), and Malaysia (266%). The weakening Yen and the rising geopolitical issues were key reasons for this (US-China relations have had an effect as well). However, by November improved dealmaking conditions mean M&A activity in the Asia-Pacific finance sector is set for a rebound even though deal count fell 2.8% year over year in the quarter ended Sept. 30.

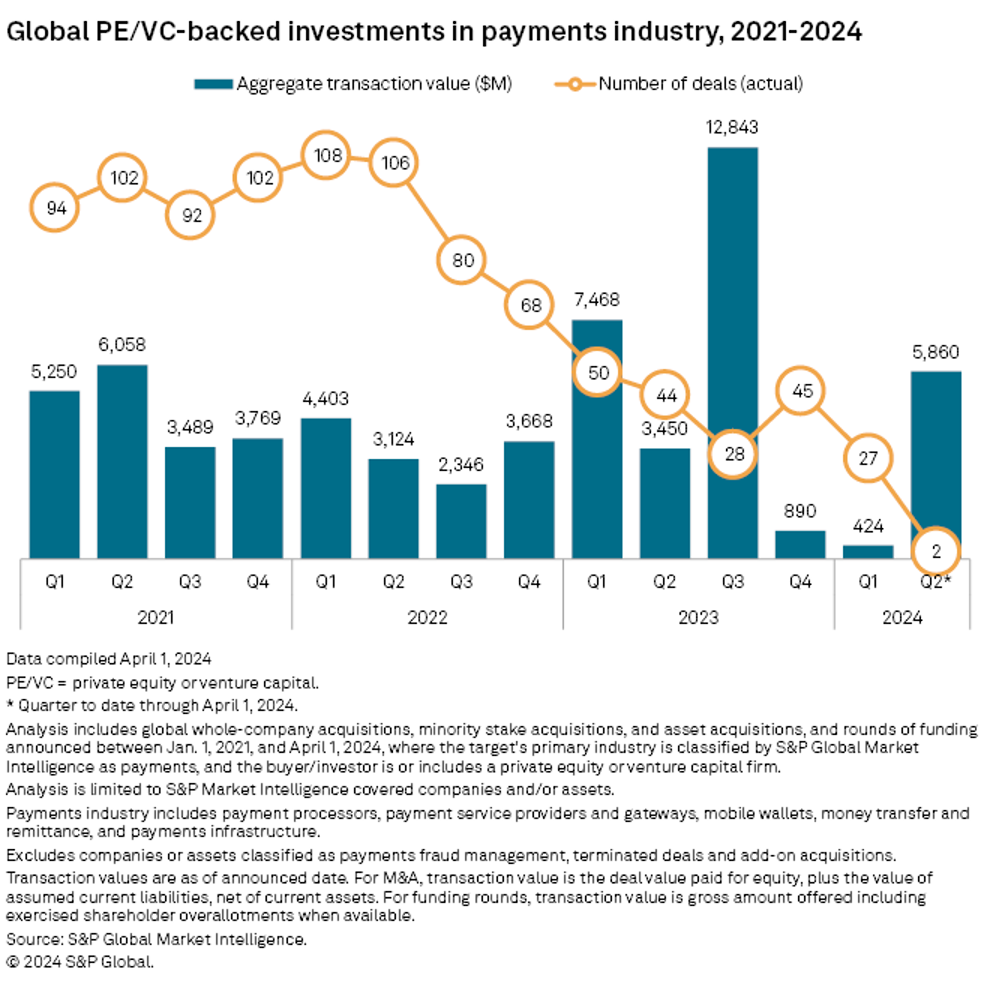

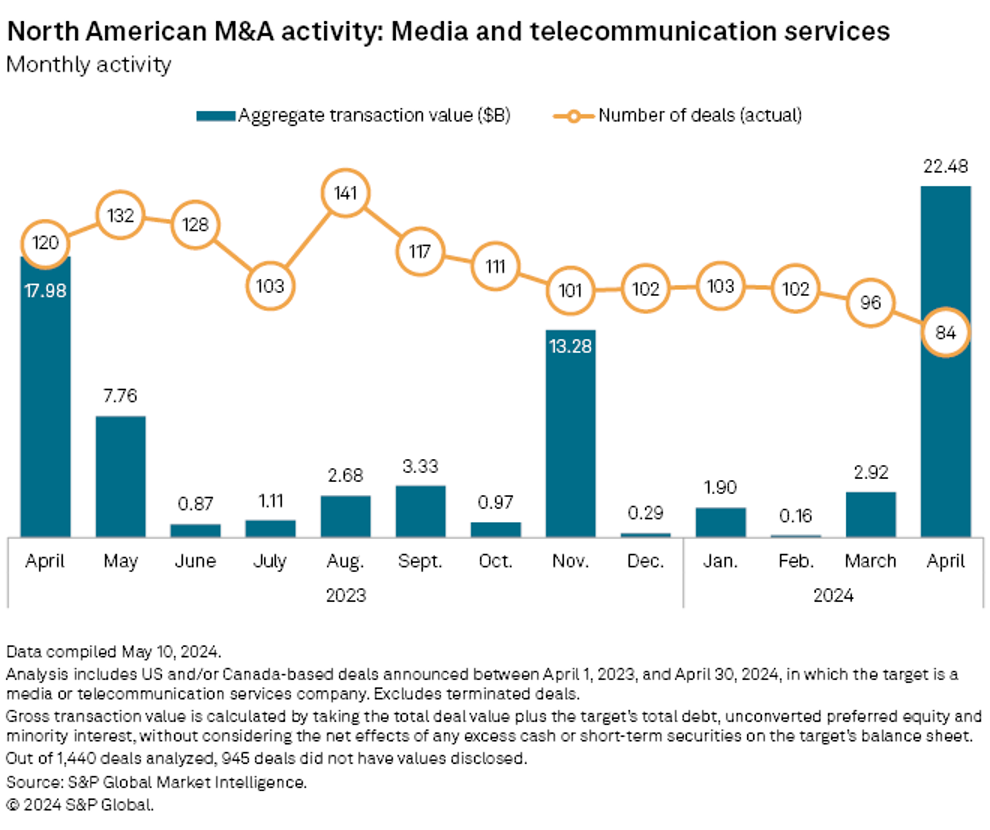

- To the extent possible, it is noticeable that the payments industry and media and telecommunications industries have experienced increasing M&A activity. These industries are like an “infrastructure play”, where they are necessary and in high demand sectors, and so they invite growth opportunities more so. Additionally, the private-equity driven deals in these industries bear higher multiples given the equity portion, thus high demand is there for these business’. And even otherwise, who doesn’t need to use that credit card ever so often, and the “high-energy, high-speed industries”, which allow for so much creativity and communications, will always be around shaping the future, though they may not seem to be big deal sectors. The illustrations following provide additional information on this and to what extent till Q2/2024.

- There have been a noticeably number of large deals, transactions valued greater than $10 billion or more. Also, strategic buyers have become less common compared to financial buyers – this makes sense to me; dry powder is more than ample, it’s a burgeoning private equity market size, and the types of PE trends they are experiencing: Five key trends for private equity firms in 2024 | EY – US. But, one does ponder as to how one can enhance the purchase price of that acquisition as strategics generally are willing to pay more in acquiring? It all still depends on the concise target list, rationale, and EBITDA considered during negotiations.

CONCLUSION

The most common and most valued incentive for securing debt and/or equity capital financing is growth initiatives, whether in the form of acquisitions or other strategic partnerships (there are other reasons too – dividend payments, and some other practical ones for companies to explore). The lifecycle of early stage to large corporate companies is about reaching the end zone through substantial net income and sustainable business models. The “invisible hand” is and should be utilized by companies of all sizes and leaders of the companies and investors alike – how else do we get anywhere in today’s capital markets?